Choose from the app stores below.

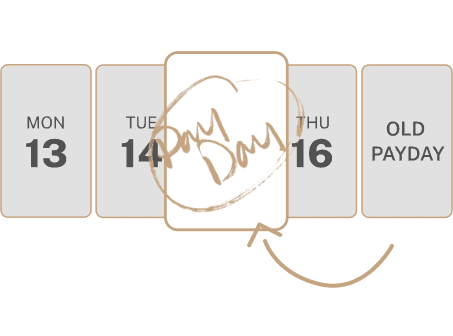

Get your paycheck up to 2 daysfaster1 with Direct Deposit

Many banks hold your paycheck until the scheduled payment date from your employer. We’re breaking tradition. With Direct Deposit your paycheck is available to you as soon as the bank receives it. You could be enjoying your payday up to two days faster!1

![block card number image]() Unlock even more with qualifying Direct Deposit

Unlock even more with qualifying Direct Deposit

Setting up Direct Deposit is simple in the Porte app!

Skip the usual steps and set up Direct Deposit in just a few taps.5 In the Porte® app, simply log into your employer’s payroll portal and link your deposit directly to your Porte account.

How to get paidfaster1 with Direct Deposit

It’s simple to set up in the app!

You can enroll in or switch your payroll Direct Deposit - no forms needed! Simply find your employer or payroll provider, submit your credentials, and make the switch! After completing some simple steps, you'll be on your way to receiving your paycheck up to 2 days faster!

Download the Direct Deposit form

In the Porte mobile banking app, find the Direct Deposit Authorization form with your routing and account numbers. Provide the information to your employer’s payroll department to complete the Direct Deposit setup process and you’ll receive your paycheck up to 2 days faster.

Find Account Information

If your employer has the ability for you to set up Direct Deposit using your company’s online HR portal, you will need to provide your routing and account numbers. It’s that simple to start getting paid up to 2 days faster with Direct Deposit.

Set up bankingalerts in the app

FAQs

Why should I set up Direct Deposit with Porte?

When you receive qualifying Direct Deposit, to your Porte account, you can enjoy some of Porte’s most powerful benefits, including no-fee cash withdrawals of up to $500 per day at ACE Cash Express stores4 and paying no fees to add money to your account at ACE Cash Express.3

When you have Direct Deposits of $1,000 or more in one calendar month, we’ll also waive your next monthly fee!2

How do I set up Direct Deposit with Porte?

Download your Direct Deposit form in the Porte app and provide to your employer, or set up directly in the app in just a few taps!5 You can also access your account and routing numbers under Account Info in the user profile.

Can I Direct Deposit my unemployment benefits?

Yes, unemployment benefits can be direct deposited into your Porte account.

Can I Direct Deposit my child support?

Yes, child support payments can be direct deposited into your Porte account.

Can I Direct Deposit my social security payments?

Yes, social security payments can be direct deposited into your Porte account.

How can I find my account information?

In the Porte app, tap the menu in the top right and navigate to Direct Deposit. There, you will find your routing and account numbers.