Choose from the app stores below.

How to use Porte's money management tool

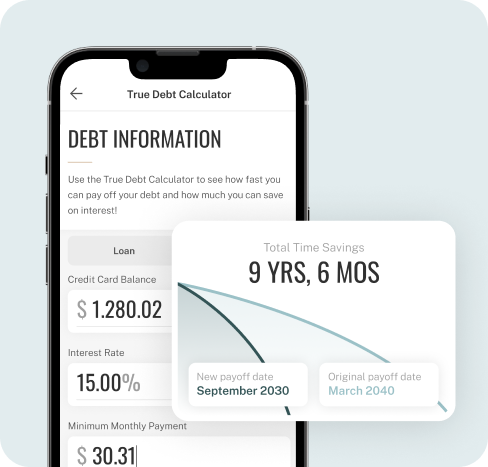

With our debt payoff calculator, you can figure out how much money and time you can save if you increase the monthly payments you contribute toward your credit card debt or other debt - such as auto loans, federal student loans, or personal loans.

True Debt Calculator

Let’s see how fast you can pay off your debt and how you could save on interest! All you need is your balance owed, interest rate, minimum monthly payment, and any extra monthly payment amount.

Total Time Savings

0 month

New Payoff Date

-

Original Payoff Date

-

Change Extra Payment

$0.00

Psst ... keep this in mind:

True Debt Calculator results are only estimates based on the info you provide. The True Debt Calculator can help give you a sense of timing and monthly payments as you put together a repayment plan. Still, it doesn't consider factors - such as your credit card annual fee (if it has one), late payment fees, or any other fees you might incur. It also assumes you won't use the credit card to make any new purchases.

Strategies for paying down debt

When looking to pay off debt, a borrower should consider these strategies to help get out of credit card debt or other types of debt.

Snowball method

With the snowball method, you start knocking out your lowest debt balance while making minimum monthly payments on everything else. After you pay off the lowest debt balance, you’ll put the money you were paying on it toward your next smallest debt.

Avalanche method

With the avalanche method, you start knocking out your debt with the highest interest rate first, reducing the total amount of interest you pay on your debt over the long term.

No results for “”

Please try another search term.

FEATURED POST

Credit Card Debt vs. Student Loan Debt: Which to Pay Off First?

Questions?

What is Porte's True Debt Calculator?

The True Debt Calculator (debt payoff calculator) is a tool available on the Porte website and in the Porte app that helps anyone calculate how fast they could pay off their debt. The tool is built for loan and credit card debt and requires a few pieces of information.

What is the interest rate?

The interest rate on a loan:

The interest rate is the amount you’ll pay as a borrower to use the line of credit expressed as a percentage. The interest rate on a loan is the amount the lender charges a borrower and is a percentage of the principal - the amount loaned.

The interest rate on a credit card:

On a credit card, the annual percentage rate (APR) is the interest rate expressed as a yearly rate. Entering an estimated APR in the calculator instead of an interest rate will help provide a more accurate calculation.

You can usually find your credit card APR by logging into your credit card account and searching for the terms and conditions.