Choose from the app stores below.

Protecting your information and keeping your money safe is our top priority at Porte®

Protecting you and keeping your money safe is our top priority at Porte®

Whether you have a Porte Spending Account or optional Savings Account, all funds on deposit are FDIC-insured1 up to $250,000 through Pathward®, National Association, Member FDIC.

Security features to protect your money

-

![]()

Transaction alerts

-

![]()

Card lock

-

![]()

Virtual Cards

-

![]()

An EMV chip

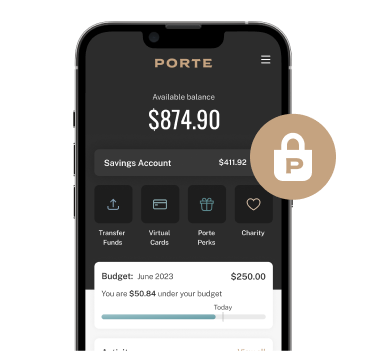

A secure mobile banking app you

can trust

A secure mobile banking

app you can trust

When you use the Porte app, there are many layers of protection.

Set a private password and PIN for login.

Rely on industry grade encryption each time

you access the app.

Enable facial

recognition at login.

FAQs

How do I report fraud?

Call Customer Support at 1-800-267-7080 as soon as you are aware of, or suspect, fraud on your account. One of our representatives will gladly assist! You can also file a dispute directly in the app by navigating to “Support & FAQ” in the app. However, if you think your card has been compromised or you are unable to locate it, please report it as lost or stolen immediately.

How do I reset my password?

If you are still able to access the app, look for Change Password inside “Your Profile” in the app menu, located under “Edit Profile Info”. If you’re locked out of your account, contact Customer Support at 1-800-267-7080 for assistance.

Are there any security tips for using the app?

The best advice is to use the built-in security features available in the app! In addition to setting up a username and a strong password, create a PIN to make sign on more secure. Stay on top of important transactional account information by turning on push notifications, which can alert you about your balance, transactions, monthly statements, and overdrafts. Toggle these to “ON” inside the “App Settings & Notifications” menu. You can also set up Virtual Cards to shop online more securely. Finally, remember that you should always be mindful of who has physical access to your device as well.